Global eCommerce Shows Signs of Recovery, Marketplaces Lead the Way: Report

eCommerce Sector Rebounds with 1.4% Growth in 2024

By ChannelMAX Staff Writer

July-2024#02

The global ecommerce landscape is undergoing a significant transformation, driven by evolving consumer behaviors, economic factors, and technological advancements. Similarweb's latest report, "The State of Ecommerce 2024: Digital Trends and Strategies for Success," provides an in-depth analysis of the digital performance in key sectors such as Beauty & Cosmetics, Luxury & Jewelry, Consumer Electronics, Marketplaces, and Fashion & Apparel. The report highlights the modest recovery in the ecommerce sector over the past 12 months, showcasing a 1.4% growth after a 3% decline in 2022.

"This overall expansion is driven by varied performance across different categories, each uniquely influenced by consumer behavior and global economic conditions," said Michelle Lang, Senior Insights Analyst of Similarweb, expressed her view on the report.

She added, "One industry that is not experiencing growth is Consumer Electronics. Shifting consumer priorities, likely influenced by economic constraints, have led to reduced spending on electronic Goods."

Here's a closer look at the report's findings:

eCommerce Sector Rebounds with 1.4% Growth in 2024

According to Similarweb's latest report, the global eCommerce sector is showing signs of recovery. After experiencing a 3% decline in visits in 2022, the industry has bounced back with a modest 1.4% growth in the past 12 months. This upturn signals a positive shift in market conditions and a gradual rebound in online shopping.

Marketplaces Dominate eCommerce Landscape

Marketplaces dominate the eCommerce landscape, accounting for over half of all visits. Despite facing economic pressures and market saturation, this category has achieved a 0.8% year-over-year growth. However, the performance varies significantly among different platforms.

Major Players Face Challenges

While the overall marketplace sector shows growth, established giants like Amazon and eBay have experienced declines in visits. This trend highlights the evolving nature of the eCommerce market and the increasing competition from newer players.

Emerging Markets Present Growth Opportunities

Developing economies such as Vietnam and Turkey are emerging as significant growth opportunities for eCommerce. Improved logistics and increasing internet penetration in these markets are driving this trend. Vietnam, in particular, has shown remarkable growth with a 24.4% year-over-year increase in visits, totaling 6.4 billion.

Mobile Apps Gain Traction

The report reveals a shift towards mobile app usage, especially in European markets. In France, app usage for top marketplaces has grown four times faster than website traffic. This trend underscores the importance of companies prioritizing their mobile app strategies to gain deeper customer insights and implement more effective targeted marketing.

Temu: The Rising Star in eCommerce

Explosive Growth and Rapid Expansion

Temu, a relatively new entrant in the eCommerce space, has emerged as a standout performer in the past year. The platform has experienced an astounding 839% growth over the last 12 months, amassing 4.3 billion visits globally. This explosive growth has catapulted Temu into the 5th largest marketplace platform worldwide.

Global Expansion Strategy

Since its initial launch in the US in September 2022, Temu has rapidly expanded its global footprint. The platform launched in Australia and New Zealand in March 2023, followed by expansions into European markets and the UK the following month. Most recently, Temu entered the South African market in January 2024, bringing its total operational presence to 49 countries.

Temu's remarkable success and aggressive expansion strategy have set it apart in the competitive eCommerce landscape. The platform's ability to quickly penetrate new markets and attract a large user base demonstrates the potential for innovative entrants to disrupt established market dynamics.

In conclusion, the eCommerce sector's recovery in 2024 demonstrates resilience and adaptability. While established players face challenges, new entrants like Temu are reshaping the landscape. The shift towards mobile apps and the growth potential in emerging markets present opportunities and challenges for businesses in the sector. As consumer behaviors evolve, companies that align with changing preferences and leverage technological advancements will likely thrive in this dynamic market.

Also Read: Navigating the Digital Commerce Frontier: Top Trends to Watch in 2024

Follow us on Facebook, X and LinkedIn to get the latest news and updates related to online selling.

By ChannelMAX Staff Writer

July-2024#02

The global ecommerce landscape is undergoing a significant transformation, driven by evolving consumer behaviors, economic factors, and technological advancements. Similarweb's latest report, "The State of Ecommerce 2024: Digital Trends and Strategies for Success," provides an in-depth analysis of the digital performance in key sectors such as Beauty & Cosmetics, Luxury & Jewelry, Consumer Electronics, Marketplaces, and Fashion & Apparel. The report highlights the modest recovery in the ecommerce sector over the past 12 months, showcasing a 1.4% growth after a 3% decline in 2022.

"This overall expansion is driven by varied performance across different categories, each uniquely influenced by consumer behavior and global economic conditions," said Michelle Lang, Senior Insights Analyst of Similarweb, expressed her view on the report.

She added, "One industry that is not experiencing growth is Consumer Electronics. Shifting consumer priorities, likely influenced by economic constraints, have led to reduced spending on electronic Goods."

Here's a closer look at the report's findings:

eCommerce Sector Rebounds with 1.4% Growth in 2024

According to Similarweb's latest report, the global eCommerce sector is showing signs of recovery. After experiencing a 3% decline in visits in 2022, the industry has bounced back with a modest 1.4% growth in the past 12 months. This upturn signals a positive shift in market conditions and a gradual rebound in online shopping.

Marketplaces Dominate eCommerce Landscape

Marketplaces dominate the eCommerce landscape, accounting for over half of all visits. Despite facing economic pressures and market saturation, this category has achieved a 0.8% year-over-year growth. However, the performance varies significantly among different platforms.

Major Players Face Challenges

While the overall marketplace sector shows growth, established giants like Amazon and eBay have experienced declines in visits. This trend highlights the evolving nature of the eCommerce market and the increasing competition from newer players.

Emerging Markets Present Growth Opportunities

Developing economies such as Vietnam and Turkey are emerging as significant growth opportunities for eCommerce. Improved logistics and increasing internet penetration in these markets are driving this trend. Vietnam, in particular, has shown remarkable growth with a 24.4% year-over-year increase in visits, totaling 6.4 billion.

Mobile Apps Gain Traction

The report reveals a shift towards mobile app usage, especially in European markets. In France, app usage for top marketplaces has grown four times faster than website traffic. This trend underscores the importance of companies prioritizing their mobile app strategies to gain deeper customer insights and implement more effective targeted marketing.

Temu: The Rising Star in eCommerce

Explosive Growth and Rapid Expansion

Temu, a relatively new entrant in the eCommerce space, has emerged as a standout performer in the past year. The platform has experienced an astounding 839% growth over the last 12 months, amassing 4.3 billion visits globally. This explosive growth has catapulted Temu into the 5th largest marketplace platform worldwide.

Global Expansion Strategy

Since its initial launch in the US in September 2022, Temu has rapidly expanded its global footprint. The platform launched in Australia and New Zealand in March 2023, followed by expansions into European markets and the UK the following month. Most recently, Temu entered the South African market in January 2024, bringing its total operational presence to 49 countries.

Temu's remarkable success and aggressive expansion strategy have set it apart in the competitive eCommerce landscape. The platform's ability to quickly penetrate new markets and attract a large user base demonstrates the potential for innovative entrants to disrupt established market dynamics.

In conclusion, the eCommerce sector's recovery in 2024 demonstrates resilience and adaptability. While established players face challenges, new entrants like Temu are reshaping the landscape. The shift towards mobile apps and the growth potential in emerging markets present opportunities and challenges for businesses in the sector. As consumer behaviors evolve, companies that align with changing preferences and leverage technological advancements will likely thrive in this dynamic market.

Also Read: Navigating the Digital Commerce Frontier: Top Trends to Watch in 2024

Follow us on Facebook, X and LinkedIn to get the latest news and updates related to online selling.

Disclaimer:

Amazon is the registered trademark of the e-commerce brand.

About ChannelMAX.NET:

ChannelMAX offers Amazon Repricer that runs on the latest AI Repricing algorithm to do Amazon Pricing Management or Amazon Repricing. Based on Amazon SP API, the repricing engine or repricer runs 24/7 and efficiently manages Amazon prices to maximize your BuyBox with profit optimization. Established in 2005, ChannelMAX has been integrated with Amazon technology since 2007, helping thousands of third-party sellers on various eCommerce platforms. Some of the eCommerce platforms, aka marketplaces, supported by ChannelMAX.NET, are Amazon, Walmart, eBay, and Shopify. Some of ChannelMAX key offerings include ChannelMAX Amazon Repricer, 2ndly, ChannelMAX Amazon FBA Audits and FBA Refunds management, an offering for managing Amazon FBA Refunds Reimbursement management for lost or damaged or misplaced inventory for which Amazon is responsible and for which sellers deserve appropriate credit reimbursement from Amazon. ChannelMAX Services offer Remote (aka Virtual) Full-Time eCommerce Assistant to help 3P sellers run their daytoday business.

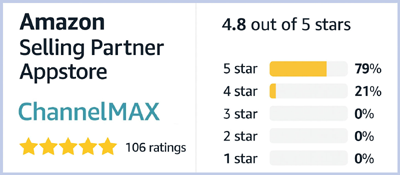

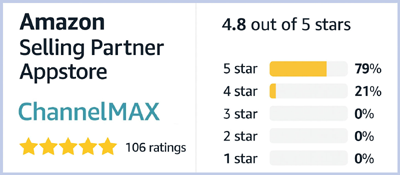

Check ChannelMAX at Amazon Selling Partner Appstore, an application with a 5 star rating.

Amazon is the registered trademark of the e-commerce brand.

About ChannelMAX.NET:

ChannelMAX offers Amazon Repricer that runs on the latest AI Repricing algorithm to do Amazon Pricing Management or Amazon Repricing. Based on Amazon SP API, the repricing engine or repricer runs 24/7 and efficiently manages Amazon prices to maximize your BuyBox with profit optimization. Established in 2005, ChannelMAX has been integrated with Amazon technology since 2007, helping thousands of third-party sellers on various eCommerce platforms. Some of the eCommerce platforms, aka marketplaces, supported by ChannelMAX.NET, are Amazon, Walmart, eBay, and Shopify. Some of ChannelMAX key offerings include ChannelMAX Amazon Repricer, 2ndly, ChannelMAX Amazon FBA Audits and FBA Refunds management, an offering for managing Amazon FBA Refunds Reimbursement management for lost or damaged or misplaced inventory for which Amazon is responsible and for which sellers deserve appropriate credit reimbursement from Amazon. ChannelMAX Services offer Remote (aka Virtual) Full-Time eCommerce Assistant to help 3P sellers run their daytoday business.

Check ChannelMAX at Amazon Selling Partner Appstore, an application with a 5 star rating.