Amazon Sellers Now Required to Provide Additional Information for UK VAT Law

By Staff Writer

Amazon has issued a notice to sellers on its platform regarding the need to confirm the location of their business establishment for UK VAT (Value Added Tax) purposes. This move is part of Amazon's compliance with UK VAT law, aiming to ensure all online retailers, including Amazon, adhere to tax regulations.

Understanding the Requirement

The request for additional information from sellers is a direct response to UK legislation effective from January 1, 2021. This legislation mandates Amazon to collect and remit VAT on behalf of sellers established outside the UK. To comply with these legal requirements, Amazon may ask sellers for further details beyond what has already been provided.

Key points include:

- Sellers might experience temporary restrictions on funds disbursement during the information review process.

- Amazon's due diligence measures are designed to minimize business disruptions for sellers.

- Detailed guidance on the necessary documentation can be found on Amazon's Seller Central VAT education page.

How Sellers Should Respond

Sellers are encouraged to submit their Determination of "Establishment" documents promptly to avoid any potential impact on their business operations. Documents can be sent directly to Amazon's dedicated email: kyc-drtax-verification@amazon.co.uk.

For those seeking further assistance or clarification regarding the Determination of their establishment status for EU VAT purposes, Amazon advises contacting Seller Support through Seller Central. Detailed assistance is available under the "Contact Us" section by navigating to KYC (Know Your Customer).

Additional Resources

Amazon has also provided resources for sellers to understand the UK VAT on e-commerce (UK VOEC) Legislation. Sellers can access comprehensive information on the 2021 Determination of "Establishment" for UK VAT through the Seller Central help page.

This initiative underscores Amazon's commitment to ensuring its seller community remains compliant with international tax laws, facilitating a seamless and legally compliant selling environment. For sellers, staying informed and responsive to these requests is crucial for uninterrupted business operations on Amazon's platform.

You can also read the following announcements made by Amazon on Seller Central:

1. How to Recover Your Amazon FBA Reimbursement with Ease

2. Amazon Sellers Face New EU Batteries Regulation in 2024: What You Need to Know

3. Amazon-Launches Multi-Channel Distribution Capability in AWD

Follow us on Facebook, X and LinkedIn to get the latest news and updates related to online selling.

Amazon has issued a notice to sellers on its platform regarding the need to confirm the location of their business establishment for UK VAT (Value Added Tax) purposes. This move is part of Amazon's compliance with UK VAT law, aiming to ensure all online retailers, including Amazon, adhere to tax regulations.

Understanding the Requirement

The request for additional information from sellers is a direct response to UK legislation effective from January 1, 2021. This legislation mandates Amazon to collect and remit VAT on behalf of sellers established outside the UK. To comply with these legal requirements, Amazon may ask sellers for further details beyond what has already been provided.

Key points include:

- Sellers might experience temporary restrictions on funds disbursement during the information review process.

- Amazon's due diligence measures are designed to minimize business disruptions for sellers.

- Detailed guidance on the necessary documentation can be found on Amazon's Seller Central VAT education page.

How Sellers Should Respond

Sellers are encouraged to submit their Determination of "Establishment" documents promptly to avoid any potential impact on their business operations. Documents can be sent directly to Amazon's dedicated email: kyc-drtax-verification@amazon.co.uk.

For those seeking further assistance or clarification regarding the Determination of their establishment status for EU VAT purposes, Amazon advises contacting Seller Support through Seller Central. Detailed assistance is available under the "Contact Us" section by navigating to KYC (Know Your Customer).

Additional Resources

Amazon has also provided resources for sellers to understand the UK VAT on e-commerce (UK VOEC) Legislation. Sellers can access comprehensive information on the 2021 Determination of "Establishment" for UK VAT through the Seller Central help page.

This initiative underscores Amazon's commitment to ensuring its seller community remains compliant with international tax laws, facilitating a seamless and legally compliant selling environment. For sellers, staying informed and responsive to these requests is crucial for uninterrupted business operations on Amazon's platform.

You can also read the following announcements made by Amazon on Seller Central:

1. How to Recover Your Amazon FBA Reimbursement with Ease

2. Amazon Sellers Face New EU Batteries Regulation in 2024: What You Need to Know

3. Amazon-Launches Multi-Channel Distribution Capability in AWD

Follow us on Facebook, X and LinkedIn to get the latest news and updates related to online selling.

Disclaimer:

Amazon is the registered trademark of the e-commerce brand.

About ChannelMAX.NET:

ChannelMAX offers Amazon Repricer that runs on the latest AI Repricing algorithm to do Amazon Pricing Management or Amazon Repricing. Based on Amazon SP API, the repricing engine or repricer runs 24/7 and efficiently manages Amazon prices to maximize your BuyBox with profit optimization. Established in 2005, ChannelMAX has been integrated with Amazon technology since 2007, helping thousands of third-party sellers on various eCommerce platforms. Some of the eCommerce platforms, aka marketplaces, supported by ChannelMAX.NET, are Amazon, Walmart, eBay, and Shopify. Some of ChannelMAX key offerings include ChannelMAX Amazon Repricer, 2ndly, ChannelMAX Amazon FBA Audits and FBA Refunds management, an offering for managing Amazon FBA Refunds Reimbursement management for lost or damaged or misplaced inventory for which Amazon is responsible and for which sellers deserve appropriate credit reimbursement from Amazon. ChannelMAX Services offer Remote (aka Virtual) Full-Time eCommerce Assistant to help 3P sellers run their daytoday business.

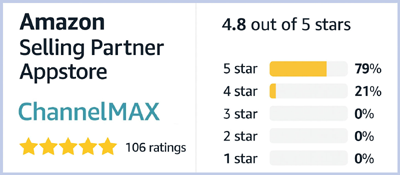

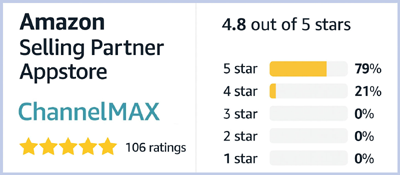

Check ChannelMAX at Amazon Selling Partner Appstore, an application with a 5 star rating.

Amazon is the registered trademark of the e-commerce brand.

About ChannelMAX.NET:

ChannelMAX offers Amazon Repricer that runs on the latest AI Repricing algorithm to do Amazon Pricing Management or Amazon Repricing. Based on Amazon SP API, the repricing engine or repricer runs 24/7 and efficiently manages Amazon prices to maximize your BuyBox with profit optimization. Established in 2005, ChannelMAX has been integrated with Amazon technology since 2007, helping thousands of third-party sellers on various eCommerce platforms. Some of the eCommerce platforms, aka marketplaces, supported by ChannelMAX.NET, are Amazon, Walmart, eBay, and Shopify. Some of ChannelMAX key offerings include ChannelMAX Amazon Repricer, 2ndly, ChannelMAX Amazon FBA Audits and FBA Refunds management, an offering for managing Amazon FBA Refunds Reimbursement management for lost or damaged or misplaced inventory for which Amazon is responsible and for which sellers deserve appropriate credit reimbursement from Amazon. ChannelMAX Services offer Remote (aka Virtual) Full-Time eCommerce Assistant to help 3P sellers run their daytoday business.

Check ChannelMAX at Amazon Selling Partner Appstore, an application with a 5 star rating.